Our statement on the recent acquisition of Griffin Forestry Estate by Gresham House and its wider implications

28 August 2025

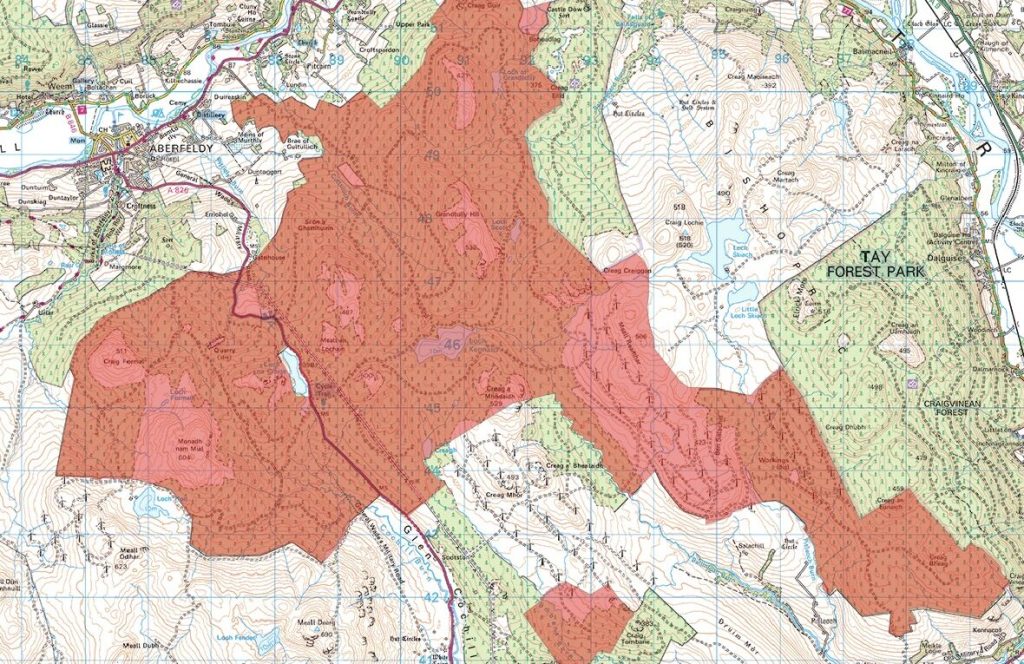

The recent sale of the Griffin Forestry Estate marks one of the most expensive land transactions in Scotland. Spanning 5,560 hectares, the Perthshire estate has been transferred to the asset management company, Gresham House, for £145 million; yet another worrying indicator of landownership concentrating into the hands of anonymous corporate investors. Andy Wightman’s coverage of this sale showed that Gresham House FF VI LLP is a limited liability partnership between Gresham House Initial Partner Ltd, ultimately owned by Searchlight Capital Partners III SED LP, a Cayman Limited partnership whose limited partners include City of Cardiff Pension Fund, Swansea Council Pension Fund, Gresham House Ltd and others. These opaque ownership structures have allowed Gresham House, as the apparent umbrella entity behind this purchase and many others, to repeatedly publicly deny that they are a significant landowner in Scotland, and as Andy’s research shows they are actually the second largest private landowner in the country.

This sale also sets the remarkable precedent that an average sized Scottish estate can sell for huge sums, which seems completely removed from the reality of many Scottish communities who are in dire need of investment in local housing, travel infrastructure and local services. This disparity raises the serious question of who is benefiting from Scotland’s natural resources and how a remote corporate entity such as Gresham House can justify a spend of £145 million in a Scottish estate, and how much of that money will be benefiting the local area.

If the sale price was £145 million, this would mean that the estate was valued at over £26,000 per hectare, which takes into account stands of mature conifers and a large wind farm rental income. This means the entire estate was being valued (per ha) around the same price as premium arable land. This, combined with the fact that Gresham House FF VI LLP have just fundraised £375 million for its forestry investment fund, demonstrates that industrial forestry and wind farm leases are clearly highly profitable.

Yet the sector still benefits from subsidies and tax breaks, as the sale particulars for the Griffin Forestry Estate emphasised. This raises urgent questions around who benefits from Scotland’s land and natural resources. The rationale for such generous public handouts to wealthy corporate investors seems unclear. If the government is seeking to incentivise trees being planted (regardless of their wider economic, social or environmental benefit) then it seems the buoyant industrial forestry market should be enough of a driver for large scale investors without handouts from the public purse.

Where land and its assets are treated primarily as vehicles for profit for private companies and pension funds, opportunities for community wealth building or wider social and economic development are limited. Additionally, such concentrated power in the hands of distant corporate entities, leaves local communities often having little say in how land is managed or what happens with profits gained from the land use which impacts them.

With the profitability of Gresham House’s sprawling forestry landholdings evident in this purchase (and their recent acquisition of the Woodland Invest portfolio) and their forestry fund, we would hope that Gresham House Forest Fund VI LP will be closely and meaningfully engaging with local communities about their plans for the Griffin estate. This should also include a discussion about what benefits from their ownership will be shared with the local people and what their ownership will contribute to the local area – in line with the Scottish Land Commission’s Land Rights and Responsibilities Protocols. We would certainly welcome early engagement with Gresham House to ensure that their new ownership benefits as many people as possible, and that they make equitable working partnerships with the strong community organisations in the local area.

Gresham House, and others, often legitimise their continued purchasing of land through their contributions to Net Zero, carbon sequestration, benefiting the local economy and the UK’s timber security, however the reality seems a little less clear cut. Recent research commissioned by Community Land Scotland has raised serious concerns about the viability of claims from forestry operators such as Gresham House, that their industrial forestry plantations make considerable contributions to timber security and carbon sequestration in Scotland. Moreover, these corporate investors skew the land market, making it harder for communities and smaller forestry operators to purchase land for forestry whilst damaging local timber economies in favour of a larger-scale extractive model.

It’s time for a serious conversation about who owns Scotland’s forests and who stands to benefit. Deals of this scale lay bare how Scotland’s land continues to be treated as a commodity, boosting profits for distant shareholders with no scrutiny as to how they will be contributing to local economic development and community wealth building. The sale of Griffin Forest Estate serves as a reminder of the urgent need for land use and land reform policies that primarily consider wider public interest and community development, which ensure transparency and accountability in ownership structures and sales, and ensure that landowners are delivering local economic opportunities rather than just extracting private profit. The Land Reform Bill currently in Parliament will provide some transparency over sales such as this and potentially allow for the breaking up of an estate such as Griffin into smaller parcels. But there should be public oversight over who is the end purchaser.

Ownership of land by pension funds from around the UK and offshore firms in the Cayman Islands will not mean land is owned to meet public priorities, local community needs or local economic development. It will be based on maximising profit and extracting that profit to shareholders. Scotland’s land and its people are our most precious resources. They both deserve better landownership than that.

For further context on the Griffin Forest Estate sale, read the news articles and blogs below, some of which include contributions from our director of Policy & Advocacy, Dr Josh Doble:

The sale was originally covered by Andy Wightman: Griffin Forestry Estate Sold for £145 million – Land Matters

The sales details were also hosted on Andy’s blog:

The media coverage can be seen here:

We have published a policy position on the current forestry sector here. This was in response to concerns from our members and wider concerns about the impacts of industrial forestry on community wealth building and land reform.

To learn more, please contact Dr Josh Doble

- josh.doble@communitylandscotland.org.uk